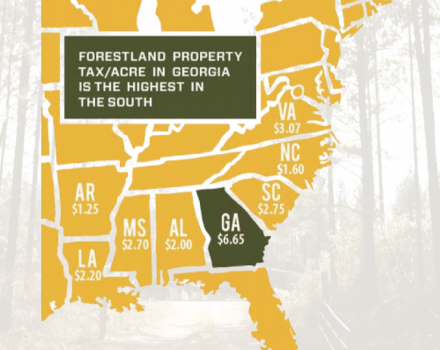

Georgia Amendment 3 Currently, forestland property taxes in Georgia average approximately three times higher than any other state in the Southeastern U.S. Amendment 3 will address this issue by: 1) provide uniformity in the valuation of timberland across the state’s 159 counties, 2) increase the conservation of forestland on properties “at-risk” of conversion to other … Continue Reading →